Payment Gateway Integration

Payment

Gateway Integration

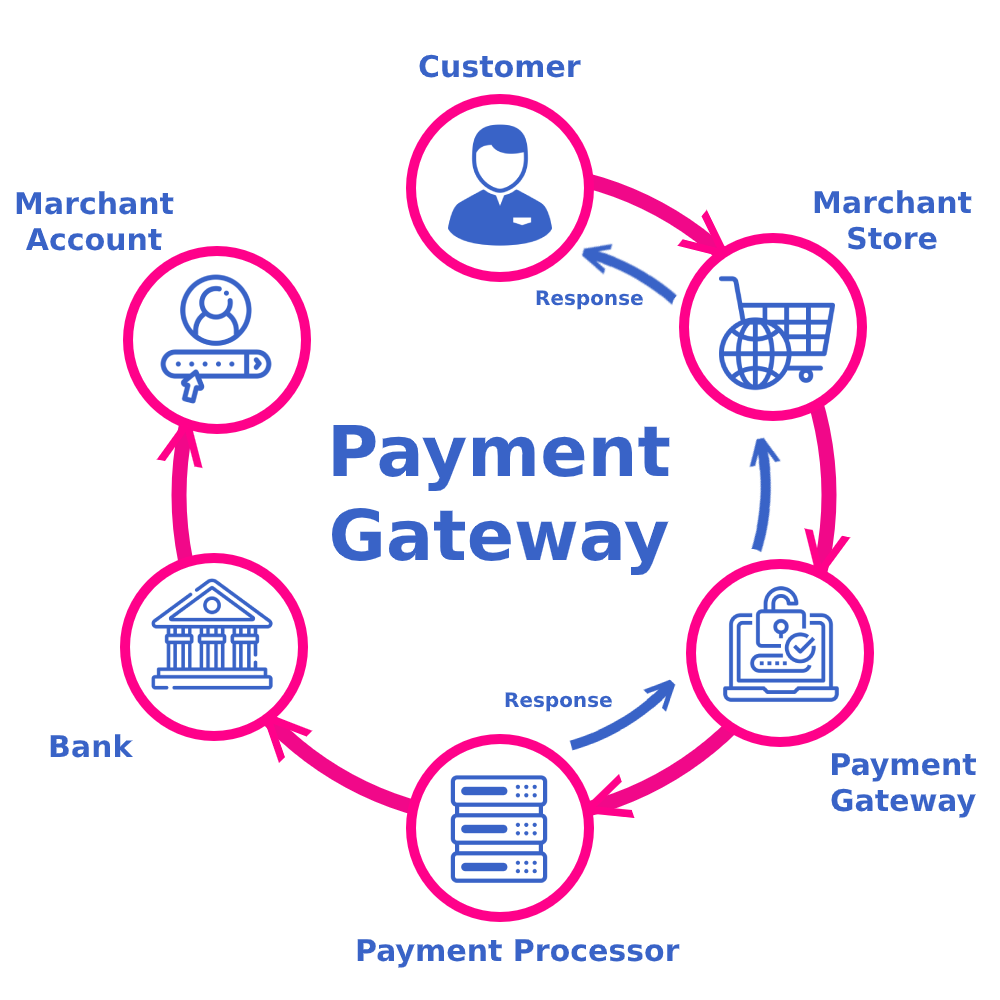

Payment gateway integration is the process of connecting an

online business or website to a payment gateway service provider, enabling the

seamless transfer of funds between customers and merchants. A payment gateway

acts as an intermediary between the customer, the merchant, and the financial

institutions involved in the transaction.

Here

are some key aspects and steps involved in payment gateway integration:

1.

Selecting a Payment Gateway Provider: There are numerous payment

gateway providers available, each offering different features, pricing

structures, and supported payment methods. It is crucial to research and select

a provider that aligns with your business requirements.

2.

Merchant Account Setup: Before integrating a payment gateway, you'll

typically need to set up a merchant account with your chosen provider. This

account allows you to accept and process payments.

3. API

Integration: Most payment gateways offer an application programming

interface (API) that allows businesses to integrate the payment gateway into

their website or application. The API provides a set of functions and protocols

for securely transmitting payment data between the customer, the merchant, and

the gateway.

4.

Development and Testing: Once you have access to the payment

gateway's API, your development team can begin integrating it into your website

or application. This involves writing code to handle payment requests,

responses, and error handling. It is essential to thoroughly test the

integration to ensure it functions correctly.

5.

Security Considerations: Payment gateway integration requires

careful attention to security measures. Implementing Secure Sockets Layer (SSL)

encryption to protect sensitive data, such as credit card information, is

crucial. Compliance with industry standards, such as the Payment Card Industry

Data Security Standard (PCI DSS), is also essential.

6.

User Experience: A smooth and seamless payment experience is vital

for customer satisfaction. Ensure that the integration provides a user-friendly

interface, supports popular payment methods, and offers a reliable and fast

payment process.

7.

Error Handling and Reporting: Implement robust error handling

mechanisms to address potential issues during the payment process. The payment

gateway should provide detailed error codes and messages, allowing you to

communicate errors effectively to customers.

8.

Go-Live and Maintenance: Once integration and testing are complete,

you can go live with the payment gateway. Monitor the payment process regularly

to identify and address any issues promptly. Stay updated with the payment

gateway provider's documentation and APIs to incorporate any updates or

improvements.

Remember, payment gateway integration may require technical

expertise, and it's crucial to involve experienced developers or seek

professional assistance if necessary. Additionally, consider factors such as

transaction fees, settlement periods, customer support, and scalability when

choosing a payment gateway provider.

By seamlessly integrating a payment gateway into your online

business, you can provide customers with a secure and convenient way to make

payments, thereby enhancing their experience and boosting your revenue.