Best Payment Gateway for Small Businesses

Choosing the Best Payment Gateway for

Small Businesses: Streamlining Transactions and Enhancing Customer Experience

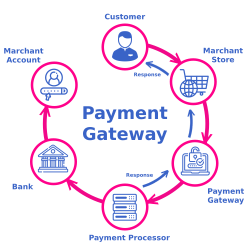

In today's digital age, having a

reliable and secure payment gateway is essential for small businesses to

facilitate online transactions. A payment gateway is an e-commerce service that

enables businesses to accept and process payments from customers via various

payment methods such as credit cards, debit cards, and digital wallets.

However, with numerous payment gateway options available, it can be challenging

for small businesses to identify the best one suited to their needs. In this

article, we will explore some key factors to consider when selecting a payment

gateway and highlight some popular choices for small businesses.

Factors to Consider:

1.

Security and Fraud Prevention: Security should be a top priority when

choosing a payment gateway. Look for a provider that offers robust security

measures, such as encryption technology and fraud detection systems. PCI DSS

compliance is also crucial to ensure that customer data is handled securely. By

selecting a secure payment gateway, you can build trust with your customers and

protect sensitive payment information.

2.

Integration and Ease of Use: Consider the ease of integration with your

existing website or e-commerce platform. Look for payment gateways that offer

seamless integration options, including ready-to-use plugins or APIs that can

be easily integrated into your website or mobile app. A user-friendly interface

and intuitive navigation are also important for smooth payment processing.

3.

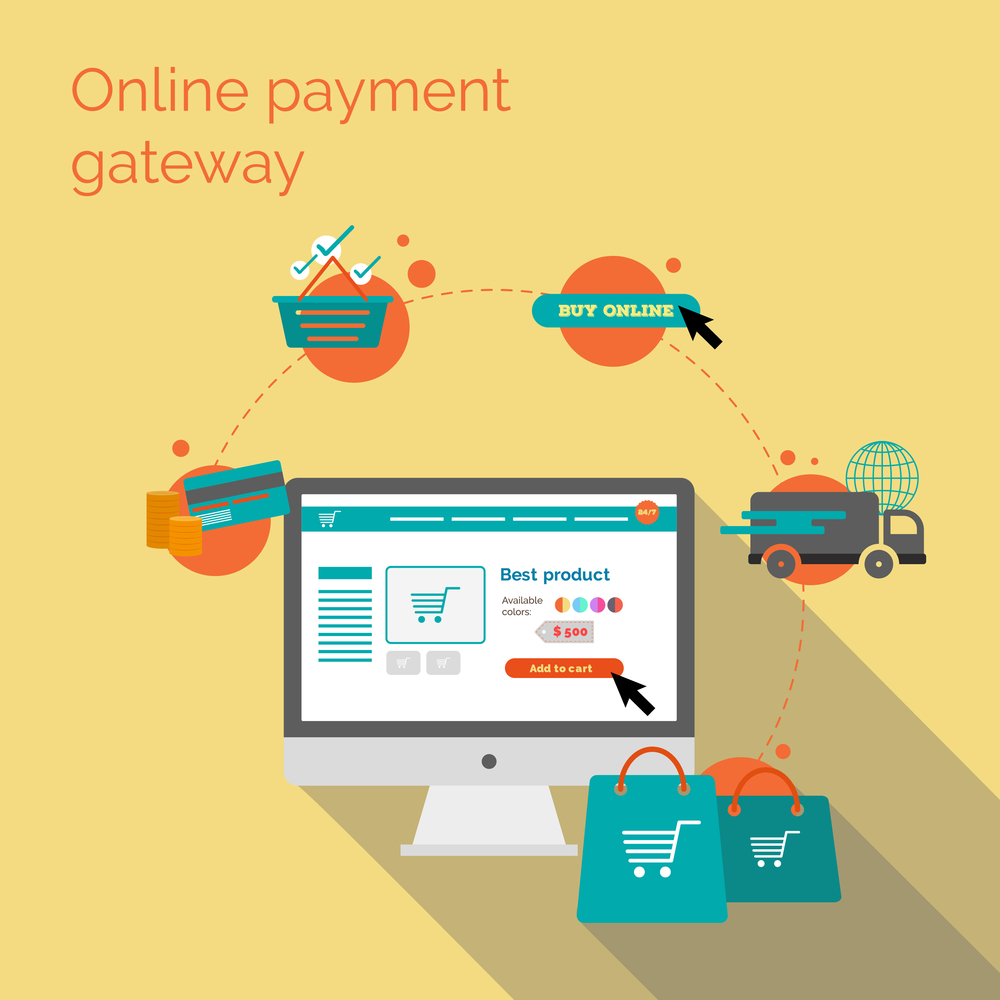

Supported Payment Methods: Evaluate the payment methods supported by

the payment gateway. The more options you offer to customers, the better their

experience. Ensure that the payment gateway supports major credit cards, debit

cards, and popular digital wallets like PayPal, Google Pay, or Apple Pay. This

flexibility can help you cater to a broader customer base.

4.

Transaction Fees and Costs: Consider the transaction fees and costs

associated with the payment gateway. Different providers may have varying fee

structures, including setup fees, monthly fees, per-transaction fees, and

additional charges for international transactions. Assess your business's

transaction volume and choose a payment gateway that aligns with your budget

and offers competitive pricing.

5.

Payment Settlement Time: The time it takes for funds to be settled in

your business account can vary among payment gateways. Some providers offer

daily settlements, while others may take a few days or longer. Consider your

cash flow requirements and choose a payment gateway that offers timely settlements

to ensure smooth business operations.

6.

Customer Support: Reliable customer support is crucial,

especially for small businesses that may require assistance during the

integration and ongoing use of the payment gateway. Look for providers that

offer responsive customer support through multiple channels, such as phone,

email, or live chat. Prompt and helpful support can save you time and ensure a

positive experience for you and your customers.

Popular Payment Gateways for Small

Businesses:

1.

PayPal: PayPal is one of the most widely recognized and trusted payment

gateways, offering easy integration, a user-friendly interface, and support for

multiple payment methods. It provides a secure payment environment and offers

flexible pricing plans suitable for small businesses.

2.

Stripe: Stripe is a popular choice for its developer-friendly API,

allowing seamless integration with websites and applications. It supports a

wide range of payment methods, including credit cards, digital wallets, and

local payment options. Stripe also provides advanced features for subscription

billing and international payments.

3.

Square: Square is known for its simplicity and ease of use, making it

ideal for small businesses. It offers a complete suite of payment solutions,

including in-person payments with its point-of-sale system. Square's flat-rate

pricing structure simplifies fee calculations, making it suitable for

businesses with low transaction volumes.

4.

Authorize.Net: Authorize.Net is a reliable payment gateway that provides

robust security features and supports a variety of payment methods. It offers

flexible integration options, a user-friendly interface, and comprehensive

reporting capabilities. Authorize.Net is particularly well